GCG Implementation Report

Annual Report

Sustainable Finance Report

Referring to OJK Regulation No.55/POJK.03/2016 and OJK Circular Letter No.13/SEOJK.03/2017 on Governance Implementation for Commercial Banks, results of the self-assessment of the Bank’s GCG implementation in the year 2022 is explained further. It is an inseparable part of the report on this governance implementation.

The Bank’s GCG implementation self-assessment was conducted by the Corporate Secretary Division in coordination with the Compliance Division, Risk Management Work Unit, Internal Audit Work Unit, and the Planning and Finance Division.

With reference to OJK Circular Letter No.13/ SEOJK.03/2017 on Governance Implementation for Commercial Banks, the criteria used in the assessment are as follows:

Governance Structure

Governance Process

Governance Outcome

Implementation of the 3 (three) indicators was evaluated on these aspects: Implementation of the Duties and Responsibilities of the Board of Directors, Implementation of the Duties and Responsibilities of the Board of Commissioners, the Committees’ Integrity and Duty Implementation, the Implementation of External Audit Function, the Implementation of Risk Management Function including the Internal Control System, Provision of Funds to Related Parties and Provision of Large Exposure, Transparency of Financial and Non-Financial Conditions, Governance Implementation Report and Internal Reporting, as well as the Bank’s Strategic Plans.

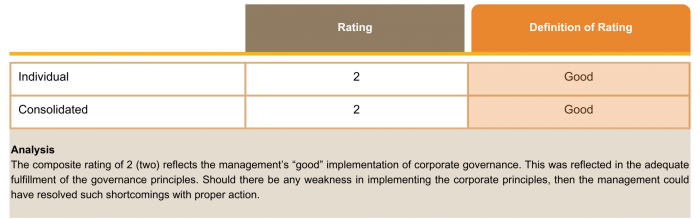

The result of the self-assessment on GCG implementation for the year 2022 was a “2” rating with a “Good” category, applied to both the individual Bank and in consolidation.

Get the easy and convenient banking from your PC, laptop, tablet, or smartphone.

SMAR&TS

TOUCHBIZ

BTPN Wow!

AksesBisnis@BTPN

Jenius Banking Reinvented

Menara BTPN - CBD Mega Kuningan Jl. Dr. Ide Anak Agung Gde Agung Kav 5.5 - 5.6 Jakarta 12950