Sustainability Overview

Bank BTPN’s Sustainability Commitment

FIND OUT MORESustainable Business

Bank BTPN’s Sustainable Finance Policy and Products

FIND OUT MORESustainability Culture

Bank BTPN’s Sustainable Operations Practices

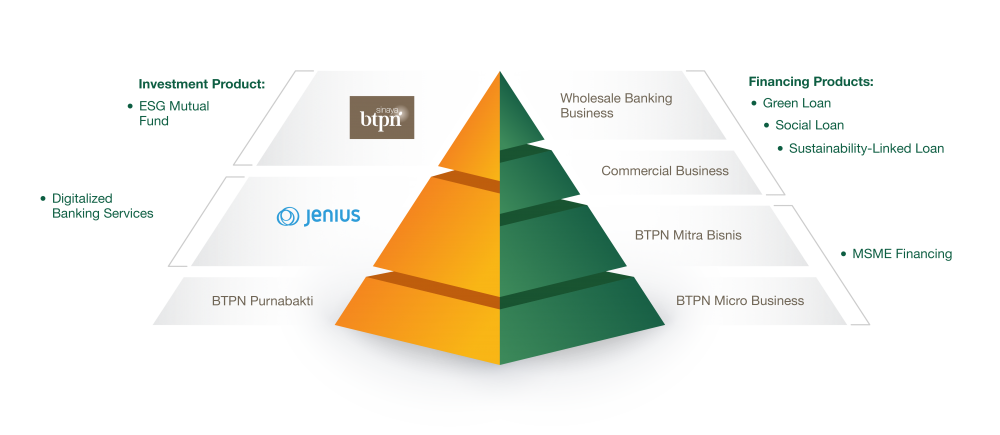

FIND OUT MOREBank BTPN provides comprehensive support for sustainable development through its business in the financial sector by aligning economic, social and environmental aspects.

Bank BTPN recognizes the crucial role of banking sector in implementing sustainable finance in Indonesia. This role is implemented by encouraging customers to transform towards sustainable business practices, which not only take into account the economic aspect, but also protect the environment, mitigate climate change, and care for the welfare of society in general.

ESG Deposit

A time deposit product designed to empower corporate ventures by funding in loans and commitments that align with rigorous ESG (Environmental, Social, and Governance).

Customers’ involvement can contribute to finance ESG projects across a wide range of categories such as renewable energy, green building, clean transportation, energy efficiency, environmentally sustainable management of living natural resources and land use, employment generation, food security and sustainable food system, socioeconomic advancement, and empowerment, etc.

For details of eligible ESG criteria can be found below: